French Paperwork

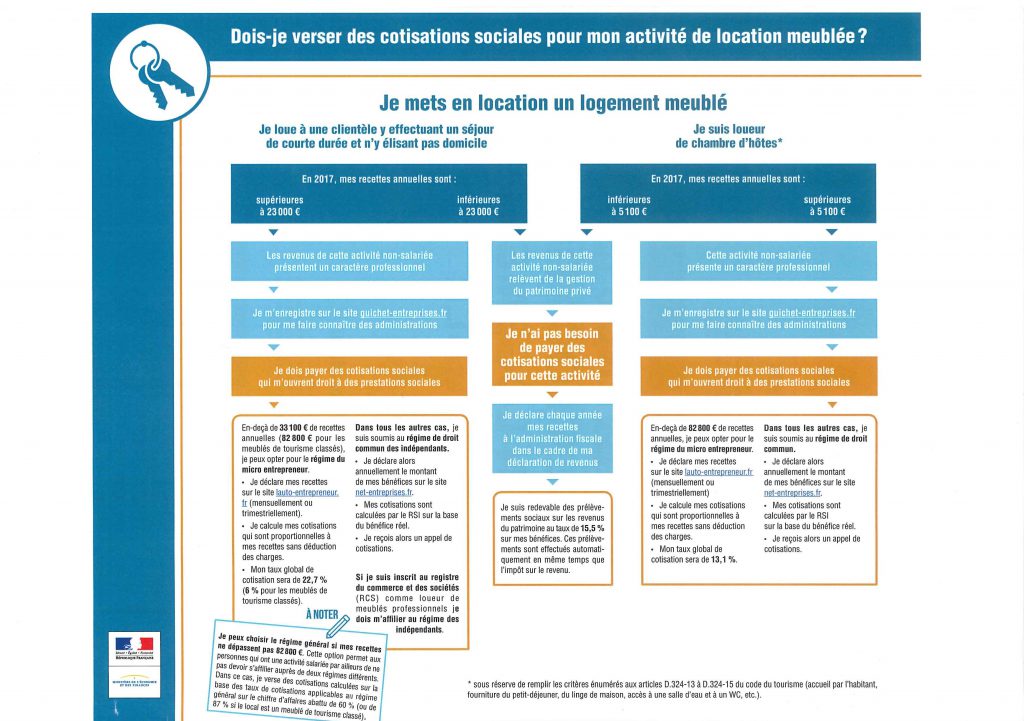

Since the 1st of January 2019 the law and rules for letting holiday properties in France have changed and especially for foreigners this requires more paperwork and costs.

The first thing an owner need to know when he wants to rent out his property is that he needs to register a business in France. The business registration of a micro-enterprise is no rocket science but requires good french skills and know-how concerning accounting, turnover limits, TVA, etc.

Since we read about the new law in 2018 we have collected all necessary information in order to help our clients.

Next to the business registration and yearly accounting we also take care of the following (obliged) administration work:

- Classification of a holiday property

- Registration number for property

- Local tax declaration

- Income Declaration

- Insurance

- Other paperwork as taxe foncièrs, taxe d’habitation, CFE

In consultation with you and your accountant we will guide your through the french bureaucracy jungle in order for your letting business to be legal, correctly declared and of course profitable.

We are looking forward to helping you!